Overview

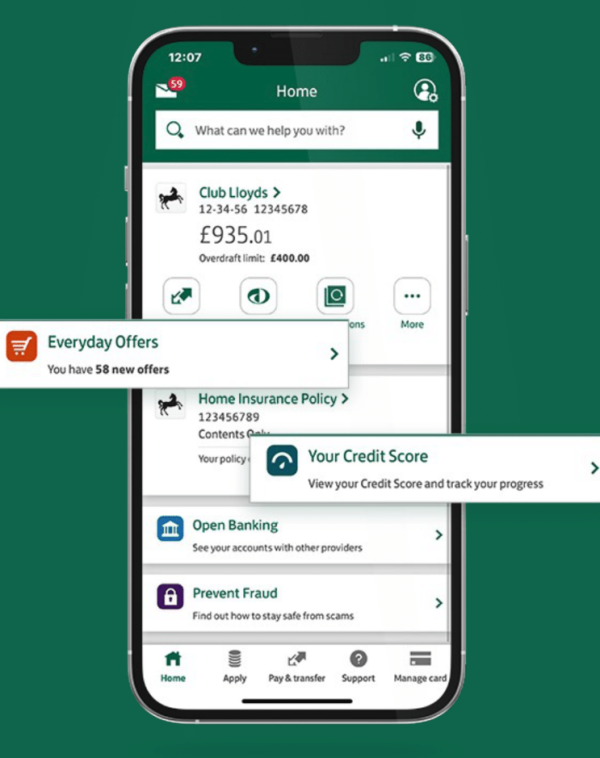

Lloyds Bank is one of the largest retail banks in the UK, serving millions of customers who rely on its mobile app to manage their finances daily.

By the time this project started, the Lloyds app was a mature, business-critical product operating in a highly regulated environment, while the organisation was also undergoing a broader brand transformation.

This project focused on reframing and redesigning the everyday banking homepage, a critical, high-traffic surface, to better reflect real customer behaviours and support clear, deliberate decisions in a highly regulated, high-risk environment.